Treasury Committee chair Nick Morgan has warned that the government may need to step in after more than 10,000 former Wonga customers were left out of pocket by the firm from “beyond the grave.”

The high-cost lender went into administration last August after a 2014 change in regulations saw the firm inundated with compensation claims, writing off debts of £220m for some 330,00 customers.

But the firm’s collapse has meant that 10,500 customers who had complaints lodged with the Financial Ombudsman Service (FOS) were not able to have their cases resolved.

And there is currently no requirement for high-cost loan customers to access the Financial Services Compensation Scheme (FSCS).

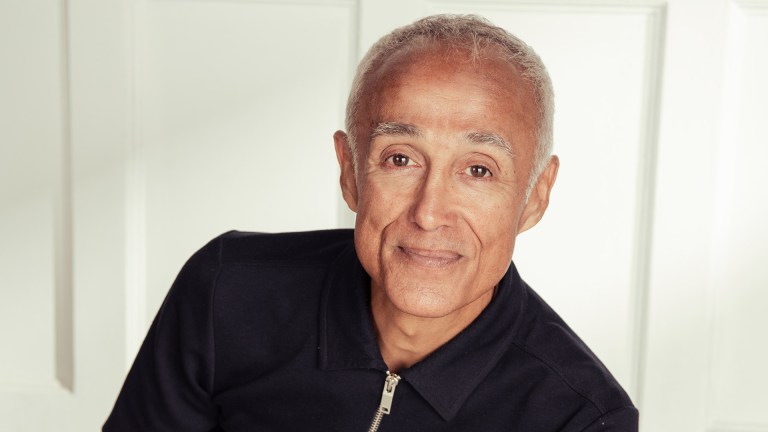

Chair @NickyMorgan01 said that Wonga compensation claimants have been "left to fend for themselves".

Read the full story here: https://t.co/fQU0bekRWB pic.twitter.com/Vkn9PedDC1

— Treasury Committee (@CommonsTreasury) February 27, 2019

Morgan has written to both the FCA and Wonga’s administrator Grant Thornton to highlight her concerns that vulnerable customers could be left out of pocket and in poverty without access to compensation of some sort.