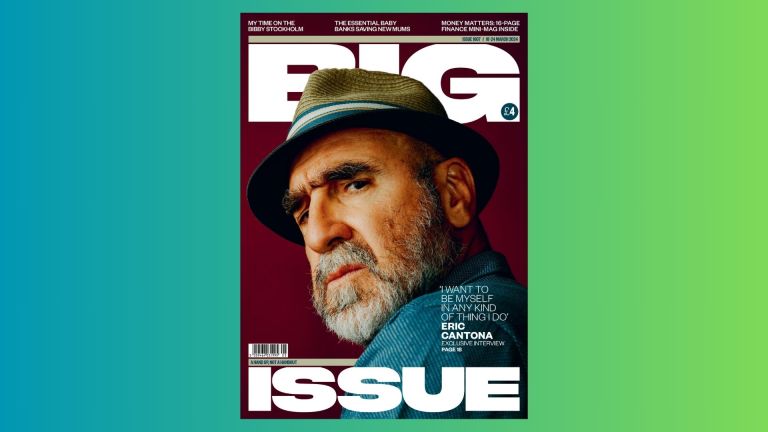

Frontline Services

Since we launched the Big Issue in 1991 our national support service teams have enabled over 108,000 vendors to earn more than £154M in income through selling the Big Issue magazine. Since 1991, Big Issue vendors have sold over 229million copies of the Big Issue magazine

Our team help vendors get set up to sell the magazine, by checking their ID, locating them a pitch to sell from, providing them with the tools to sell, such as free magazines to get started and badges to ensure the public know they are legitimate sellers. This enables people to come to the Big Issue and start earning a living from day one.

Our support service teams also support vendors to access other basic services to help improve their lives. This can include anything from Housing, Health & Wellbeing support including mental health, access to ID and bank accounts, providing fuel and food vouchers, or vital forms of training and support to move vendors into sustainable and long term employment.

Over the years, we have provided 36,000 vendors with access to Health & Wellbeing support, 26,000 vendors with access to Housing support and 32,000 vendors with Financial & Digital support.

We are proud to work with a series of organisations who help support our work with vendors.

You too can help fund our vital work, by making a contribution here.

Your support is vital in helping more people to work their way out of poverty, during this cost-of-living crisis.

Frontline Services

Frontline FAQs

Vendor News

Letters: DWP wants to make it as hard as possible to look after my disabled relatives

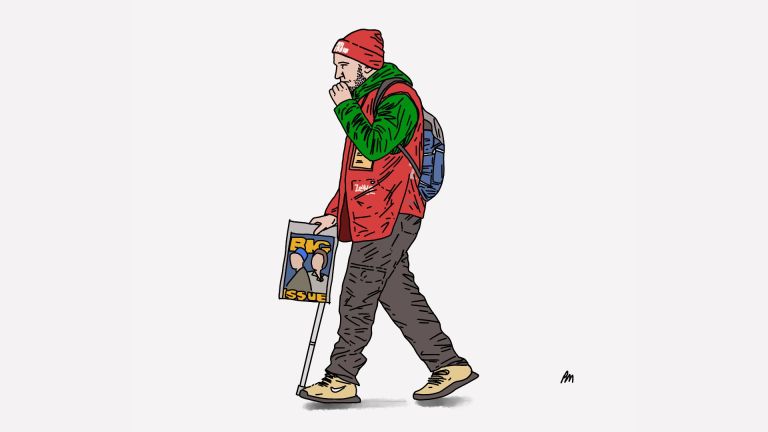

Artists pays tribute to Big Issue vendors in thought-provoking project: ‘Ordinary moments go unnoticed’