Bootstrap Cook writer Jack Monroe has revealed that a lack of financial data has even had an impact on her ability to access credit despite being a successful author.

Monroe, 30, revealed that she has been repeatedly turned down for an overdraft and was left struggling to make ends meet because of a thin credit file. That puts her among the 5.8 million people who are ‘invisible’ to the financial system, limiting their ability to borrow from mainstream sources and forcing them to turn to unscrupulous high-cost lenders.

Big Issue Invest, our social investment arm, has been working with the credit reference agency to change that reality for those with no access to fair credit with the Rental Exchange.

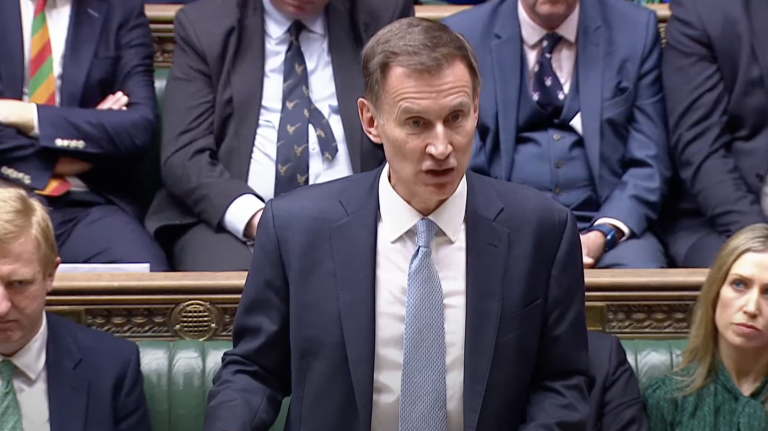

Big Issue founder Lord John Bird is taking the idea a step further with his Creditworthiness Assessment Bill, which is currently awaiting its second reading in the House of Commons after passing through the House of Lords without amendment.

Being excluded from mainstream credit is not just an issue affecting the poor, families on average incomes, middle-aged adults with low income and pre-retirement households are all affected as well as young twentysomething renters.

Monroe is now encouraging Brits to build up their credit file to avoid the financial exclusion that has plagued her in the past.