The Financial Conduct Authority (FCA) has issued a warning to high-cost lenders to clean up their act following the demise of Wonga.

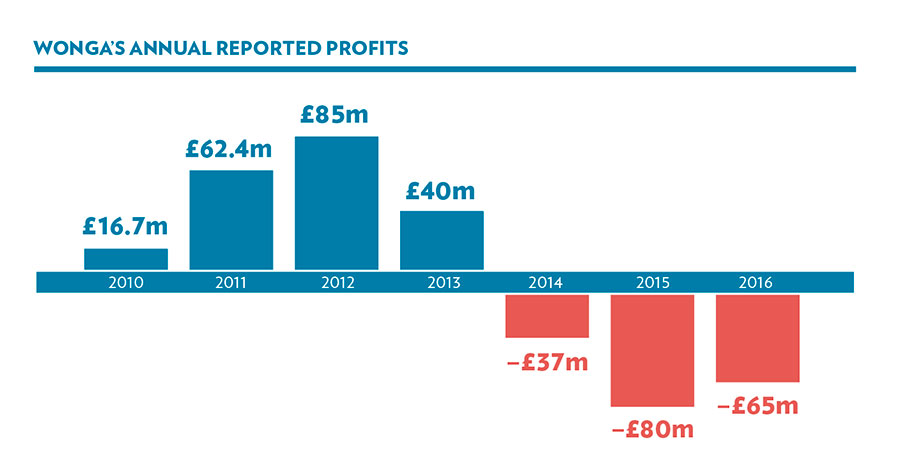

The regulator has taken aim at the rising number of complaints made against some of the industry’s biggest names and also insisted that mis-sold loans must be repaid to the borrower. It was this insistence that proved to be the undoing for once-market leader Wonga, which was ordered to pay £2.6m in compensation to 45,000 customers and write off debts for 330,000 customers, following an FCA crackdown.

Now, FCA chief executive Andrew Bailey has penned a letter to high-cost lenders CEOs stressing that firms should take into account “the scope and severity of the consumer detriment” from their actions. He also stressed that “consider whether it is fair and reasonable for the firm to proactively undertake a redress or remediation exercise, which may include contacting customers who have not complained”. Complaints have skyrocketed, according to Financial Ombudsman figures, with the majority of the lenders in the sector seeing the number of new cases rise in the last year.

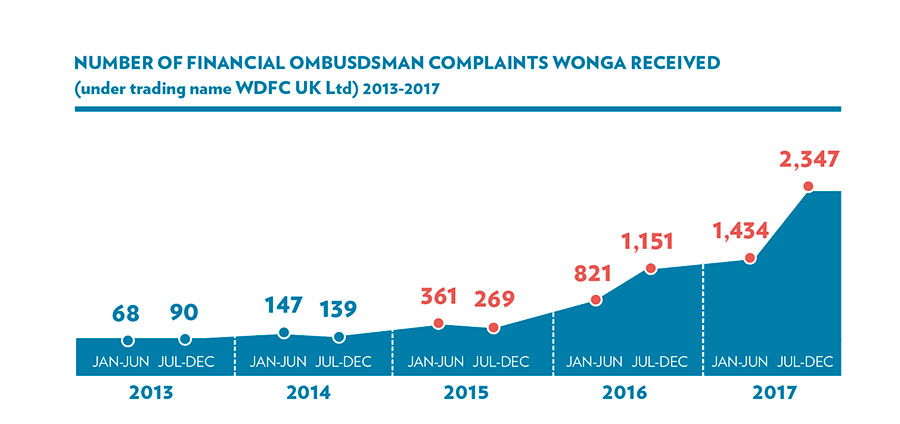

CashEuroNet UK – Quick Quid and Pounds to Pocket parent company, saw an increase from 1,212 new cases between January and June 2017 to 4,692 cases for the same period a year later. Wonga’s own larger body, WDFC UK, experienced a rise from 1,434 to 4,520, while new cases against Elevate Credit International – the owner of Sunny – shot up from 279 to 839. Satsuma’s own parent firm Provident Personal Credit also follow the trend with new cases up from 266 to 1,192 over the same period.

Overall, there were 10,979 new complaints relating to payday loans between April and June 2018 – significantly higher than the 3,126 received in the same period 12 months previously.

The Consumer Finance Association (CFA) has insisted that this complaints rise comes off the back of an FCA crackdown that paved the way for an avalanche of claims.