“It has cost me work many a time and I’m talking about jobs that any man on the street can get – I’m not talking about brain surgery here. If I have to be paid into a bank account and can’t be paid in cash then I have lost the job.”

Typically proof of address, like a recent utility bill, a tenancy agreement, or a council tax bill, is required to open a bank account.

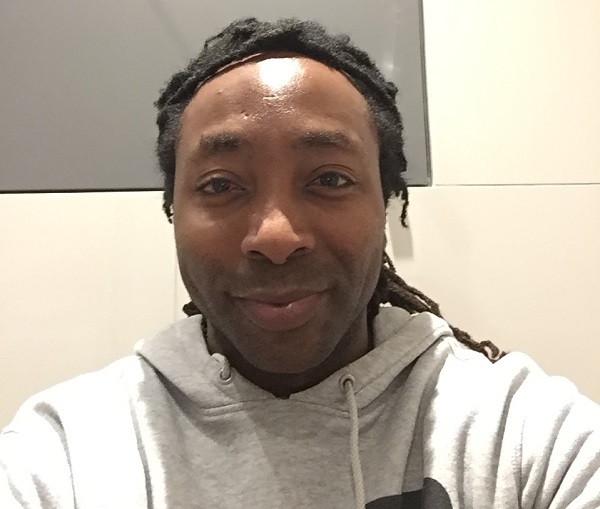

That requirement prevented Kendrick from opening his first bank account until he was 33 years of age at the start of the pandemic in March 2020,through HSBC’s No Fixed Address service. Launched in December 2019, the scheme has now allowed more than 1,000 people who are homeless to open basic bank accounts.

The service works with homelessness charities to identify people who need to open the accounts without photo ID or proof of address.

HSBC’s move has been the most significant national effort a major bank has taken to address the issue. In recent years, the rise of challenger banks, such as Monzo, has reduced the barriers to opening an account but the digital option comes with the need for a smartphone and photo ID while traditional high-street banks, such as Lloyd’s Bank, have combatted financial exclusion on a smaller scale.

Without a bank account, people face exclusion from the financial system that most people in society take for granted. It can make escaping homelessness even more difficult.

Advertising helps fund Big Issue’s mission to end poverty

The Big Issue has also been working to combat financial inclusion in recent years and teamed up with ProxyAddress in 2019 to help Big Issue vendors open accounts, using empty homes in the UK to create a duplicate ‘proxy’ address for data purposes.

Vendors have also been supported in their pitches through The Big Issue’s partnership with Zettle to offer contactless payments to their customers.

While Kendrick is still sofa surfing, he insisted getting a bank account has changed his life and offered him the chance to save towards his “simple dream” of training to be an electrician.

“It changes your life ten-fold,” he added. “It sounds silly to most people because they have always had an account but now everything is cashless and on your smartphone, it really does change your life if you have a bank account.

“If you can’t use your card, you’re a bit-part of society and you might as well not exist. It has changed things in unimaginable ways. It also gives me lots of hope for the future.”

HSBC announced on Thursday it was broadening the scheme to Stonewall Housing to help LGBTQ+ individuals experiencing homelessness get access to a bank account.

Advertising helps fund Big Issue’s mission to end poverty

Between 64,000 to 128,000 members of the LGBTQ+ community are currently homeless, according to Stonewall Housing. Meanwhile, Shelter research found people who identify as bisexual or as gay or lesbian are more likely to find it hard to find a safe and secure home than heterosexual people.

Maxine Pritchard, head of financial inclusion and vulnerability at HSBC UK, said: “Without a bank account, people can’t receive benefits which means they can become trapped in their current situation. That just simply isn’t fair.

“Through our work with Stonewall Housing we will be able to make a difference to the lives of homeless LGBTQ+ people in London and we are hoping to partner with other LGBTQ+ charities so we can help individuals across the UK.”