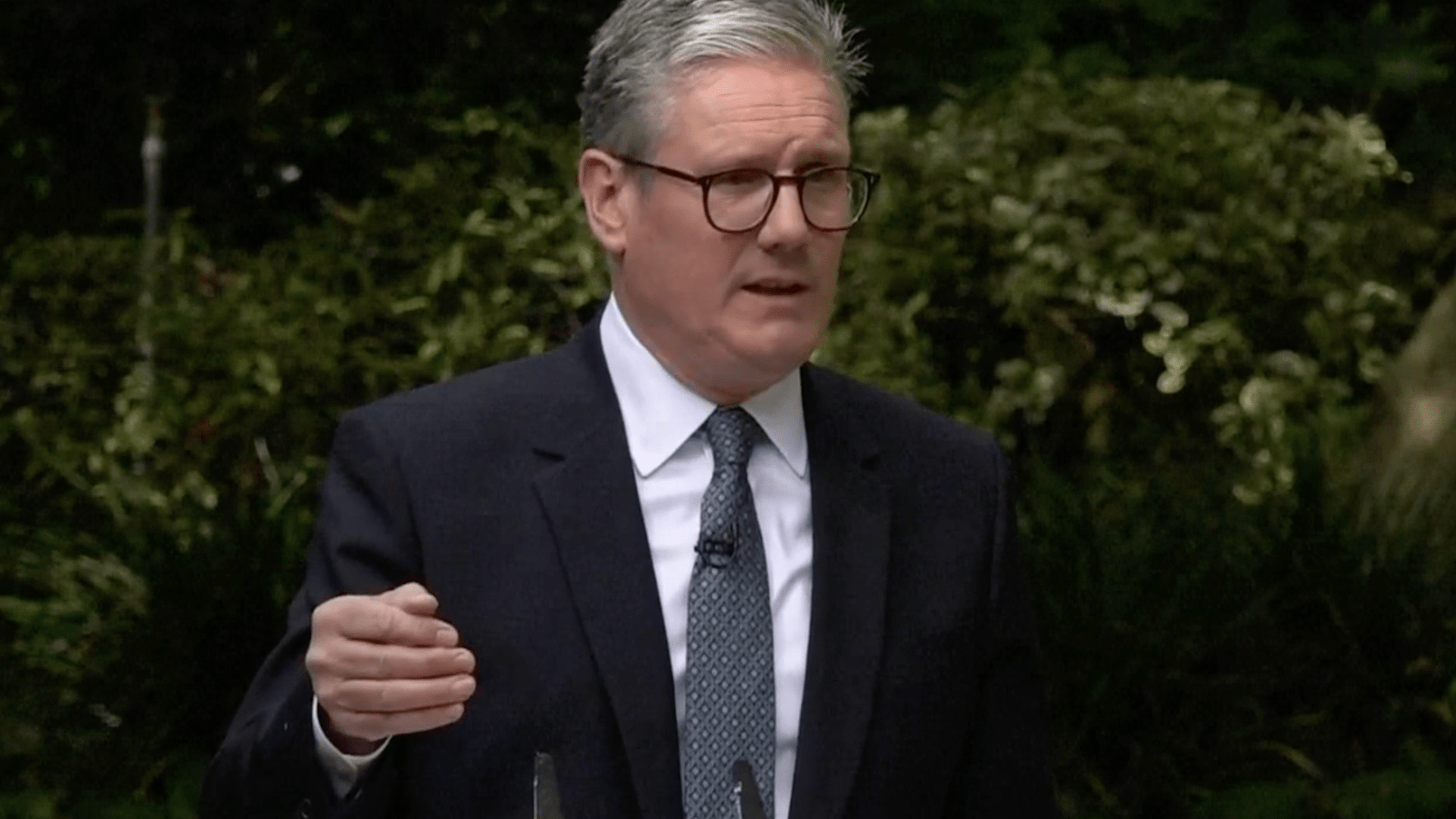

The winter fuel payment is a sum of up to £300 to help pensioners pay their heating bills over the winter, but Starmer said it is “not a particularly well-designed scheme” and his government will look at ways to increase the uptake of pension credit.

Pushed on the decision by journalists, Starmer added: “I didn’t want to have to deal with the winter fuel allowance for pensioners, but we have to fix the NHS.

“We have to fix our homes, our schools and pensioners rely on those in the same way as anyone else does. So I’m not going to preempt the budget, but I’m absolutely not going so accept that the inheritance we have is anything other than dire.”

But there are fears that the decision to scrap the winter fuel payment for the majority of pensioners could increase pressure on the NHS.

Simon Francis, the coordinator of the End Fuel Poverty coalition, said: “The impact of living in cold, damp homes is particularly harsh on those older people with a disability, a long-term health condition or with poor mental health. It results in people turning to an NHS and, in some cases, can result in additional winter deaths.”

It comes days after energy regulator Ofgem announced that energy bills are set to rise in October.

The energy price cap – the average amount a typical household pays on energy bills each year – will be set at £1,717 from October. It means that energy bills will rise by an average of £149 in a year.

Francis added: “Ending energy debt, extending the household support fund, expanding warm home discounts and evolving standing charges are all now needed urgently to help mitigate the impact of high bills and the axe to the winter fuel payment.

“But as well as support this winter, the public need to see a clear timetable for when the very real benefits of cheaper renewable energy and the Warm Homes Plan will kick in.”

What could the government do to raise funds instead of restricting the winter fuel payment?

Labour has repeatedly ruled out changes to VAT, national insurance and income tax to plug the £20bn “black hole” in public finances. The government is, however, reported to be considering a hike to capital gains tax.

There are calls for the government to reform pension tax relief for workers instead of cutting back the winter fuel payment.

According to the Fabian Society, pension tax relief costs the country more than £60bn per year and half this money goes to higher and top-rate taxpayers.

It calls for a series of reforms including for the government to subject pensions to inheritance tax; a flat rate for tax relief for pension contributions for all tax bands rather than giving more back to higher taxpayers; and for the government to reduce the maximum tax-free lump sum to £100,000 or 25% of pension wealth.

The Fabian Society also wants the government to charge employee national insurance on private pension incomes (with an allowance to exclude small pensions). But this would be “controversial” as it would raise taxes for pensioners.

The Institute for Fiscal Studies (IFS) has estimated that introducing a flat, 30% tax on pension contributions could bring in £2.7bn a year.

Andrew Harrop, the general secretary of the Fabian Society, said: “Rachel Reeves needs to raise revenue while also safeguarding family living standards. But there are choices as to how she does this and who is targeted.

“As part of her tax-raising October budget, instead of the blunt tool of means testing winter fuel allowance, the chancellor should introduce reforms to pension tax relief that save money, protect low and middle earners and target only people with higher incomes.”

Do you have a story to tell or opinions to share about this? Get in touch and tell us more. Big Issue exists to give homeless and marginalised people the opportunity to earn an income. To support our work buy a copy of the magazine or get the app from the App Store or Google Play.