Looking at your bank balance every month and wondering how people ever manage to afford to buy a home? Surprise, surprise: people are much more likely to get on the property ladder if they have wealthy parents who give them cash to top up their salaries.

A new report from the Institute for Fiscal Studies (IFS) has found £17 billion is gifted or loaned informally each year, mostly from parents to their adult children. More than half of this money (53 per cent) then goes towards buying a home or improving a property.

As young people face rising house prices and stagnant income growth, the “bank of mum and dad” is becoming increasingly important.

Get the latest news and insight into how the Big Issue magazine is made by signing up for the Inside Big Issue newsletter

The average – mean – amount people receive over an eight-year period of their early adulthood is around £6,500, while the median amount is £2,200. But people who put their money towards buying a house or making improvements to their home received an average of £20,000 from their family.

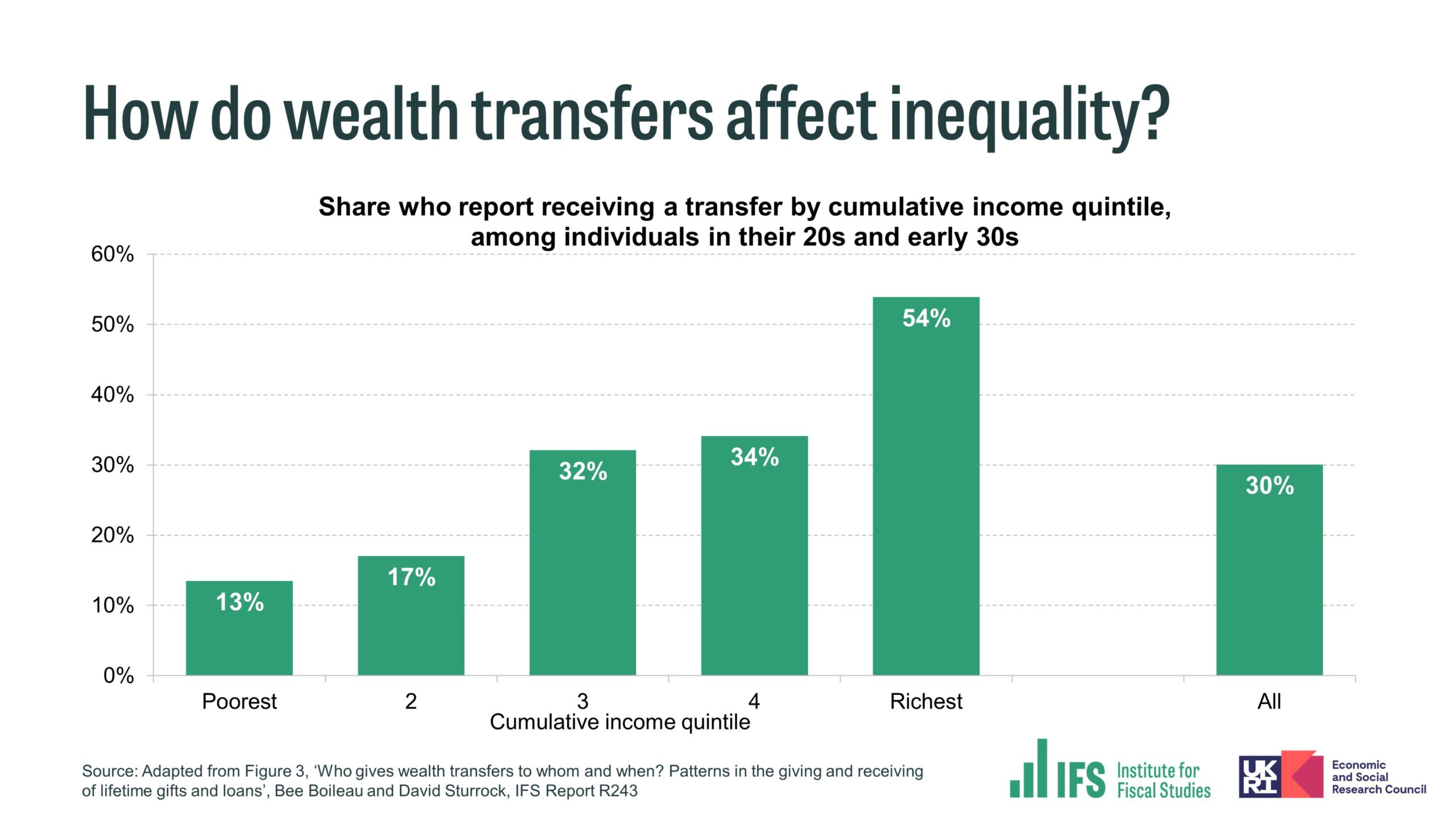

This is deepening inequality among young people. Over half of gifts and loans are given by the wealthiest fifth of adults, who are almost exclusively homeowners and disproportionately living in London and the south-east.