Paying court costs and bailiff fees will add to the debt for those who can’t pay, while the actual cost of summonsing to court can easily rise up to £100 despite an actual cost of £3. All these outgoings can keep a resident mired in the cycle of poverty.

As debt charity StepChange’s senior public policy advocate Robbie de Santos concludes in his report: “Many councils’ practice in collecting council tax arrears leaves a lot to be desired. A lack of focus on affordable, sustainable repayment for struggling residents is pushing people into deeper financial difficulty.”

De Santos also called for central government to step in and offer protection from enforcement for people who are trying to lift themselves out of swelling debts.

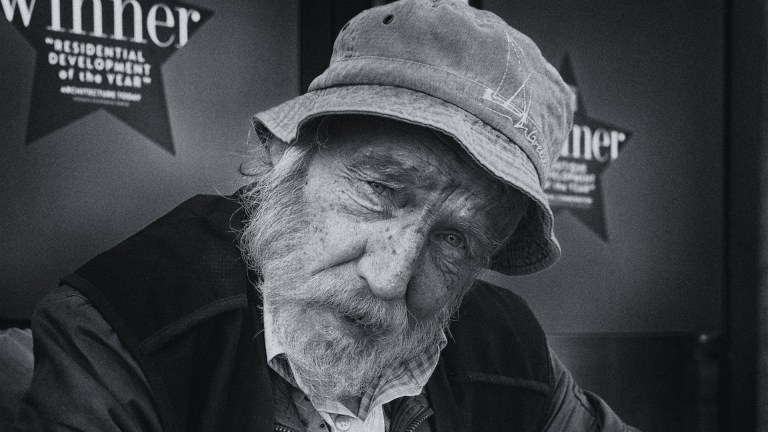

But if the money owed continues to skyrocket then it can easily lead to the streets through the loss of a home or even a spell in prison.

Last year, magistrates’ courts in England and Wales granted 3.5 million council tax liability orders, although only a small, yet significant, proportion ended up in the dock.

A total of 4,817 people were taken to court in 2016/17 – a figure that has risen by 11 per cent in four years, according to the Institute of Money Advisers.

And 62 were locked up by magistrates for their failure to pay, with a maximum sentence of three months. The average debt racked up by those dragged to court was £2,213.

Families are living in fear of a visit from the bailiffs, and small missed bills can skyrocket through excessive enforcement fees

The price of staying out of prison is on the rise. David Cameron’s council tax freeze, introduced in 2010, was scrapped last year, with cash-strapped councils offered the option to raise charges by up to three per cent.

Naturally local authorities leapt at the chance, with 108 councils opting to increase fees by 2.95 per cent or more while 64 chose to charge the maximum 2.99 per cent.

The helping hand to cover those costs has also been reformed in recent years, with council tax benefit replaced in 2013 by local authority-run council tax reduction schemes.

And just one month when the funds don’t stretch far enough can bring the bailiffs knocking. A House of Commons Treasury committee heard in July that local authorities passed £2.3m of debt cases to bailiffs – a practice that was deemed “worst in class” by ministers.

Last week, Citizens Advice revealed the scale of the debt collection problem for their clients, with one person every three minutes contacting the charity about bailiff issues. The advice service found that UK households have fallen behind on essential bills to the tune of £18.9bn, with council tax arrears making up £2.84bn of that total. And when bailiffs are on the case there can be a rising mental toll on top of the financial one.

“Families are living in fear of a visit from the bailiffs, and small missed bills can skyrocket through excessive enforcement fees,” says Gillian Guy, chief executive of Citizens Advice.

“Our evidence shows aggressive tactics by bailiffs cause huge distress and can even push people further into debt. Families are going without essentials like food or electricity to meet their payments.”

In 2016 the Ollerenshaw Report recommended the liability order to be sidelined in favour of a voluntary agreement with the council. It was claimed this would give residents the “time, information and capacity to make an informed decision”.

But there is no sign of the government scrapping it in favour of a softer approach. They responded to the recommendations in January this year, claiming the order “protects the legal interests of residents” even though they “acknowledged the order adds costs to debts”.

Access to fair credit is key and could transform the way working people cope with a cost-of-living crisis. The Big Issue has long banged the drum for changes to the industry, with founder John Bird’s Creditworthiness Assessment Bill one of the ideas that could help people keep their heads above water.